The combined FTTx and mobile fronthaul and backhaul markets will consume more than 115 million optical devices in 2016, worth some $1.7 billion in revenue to components makers. Close to 70% of these products will be deployed in China. However, demand for access optics in China is projected to moderate in 2017-2021, since FTTH and 4G LTE upgrades are nearing completion. Access infrastructure projects in developing countries and deployments of next generation optics in the developed world, including China, are projected to sustain market growth in 2017 and beyond.

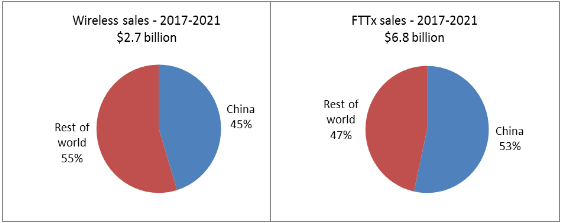

Global sales of optics for mobile infrastructure and FTTx are projected to exceed $2 billion by 2021 with the contribution of China declining to 50%. Despite modest growth forecasted for this market segment, it will remain a significant opportunity for suppliers, adding up to nearly $10 billion over the next 5 years, as illustrated in the figure below.

Figure 1: China as a percent of worldwide sales of access optics, 2017-2021

Chinese service providers will continue to invest in networking infrastructure, but their priorities are shifting from deployments of FTTH and wireless fronthaul optics to adding bandwidth in metro-access and metro-core networks. While China became number one in the world in terms of the number of FTTH and 4G LTE subscribers, the actual speed of Internet access in China remains below the global average. Lack of bandwidth in metro networks is considered a bottleneck and the government is urging service providers to resolve this problem.

China has what could be the best environment for a healthy access optics demand of any country. It has the world’s largest population, living in largely urban settings, with a central government willing to spend large amounts of money on infrastructure such as internet access. While some small countries have achieved much higher penetration rates of FTTx and mobile broadband, the other large countries have relied to a great extent on market forces to direct investment in fixed and mobile broadband. As a result, China has been and will remain the largest single-country market in terms of consumption of both wireless and fixed access optics for the next five years.

None of the other countries in the world will be able to replicate the scale of FTTH and 4G LTE deployments in China over the last 3 years. The scale of FTTH projects planned in India and Indonesia are at least 10 times smaller. However, the developing countries collectively are projected to make a significant contribution to the global market for access optics in 2017-2021. Chinese equipment manufacturers are likely to take a lead in facilitation of these projects around the world, exporting their expertise and technology. With many Western democracies becoming wary of globalization, China’s assistance will be welcomed by the developing world.

Deployments of 5G mobile infrastructure is projected to start in 2020 and it will give a boost to the wireless fronthaul market. However, it is very likely that CPRI connections will be replaced with retimed Ethernet, which requires less bandwidth. This change in fronthaul connectivity limits the prospects for high speed optics sales growth for this application.