Volume deployments of 100GbE optics in mega data centers have finally started. The second half of 2016 is expected to be strong and 2017 should be even better. Demand is high and suppliers are scrambling to keep up. Shortages of high-end optics, such as EML and DFB laser chips, is the main limiting factor for 100GbE market growth in 2016.

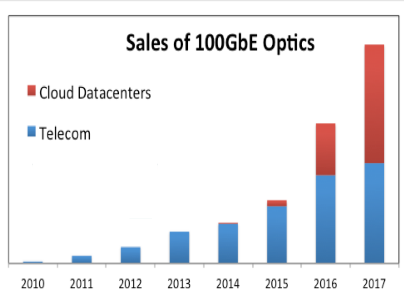

The demand for 100GbE in telecom is also very strong, as illustrated in the figure below. Shipments of CFP and CFP2 transceivers were ramping up for several years and large telecom customers, led by Huawei, have a tight grip on the 100GbE supply chain. Sales of 100GbE for telecom applications will continue to increase, but Cloud Datacenters are expected to become the largest consumer of 100GbE optics in 2017.

The main surprise of 2016 so far is a very high demand for 40GbE datacenter optics. Leading cloud companies reduced purchases of 40GbE transceivers in late 2015 and that trend was expected to continue this year. Sales data collected by LightCounting for the first half of 2016, released in the latest quarterly market update report, showed very strong sales of 40GbE products.

Supply shortages in 100GbE optics contribute to the continuing deployments of 40GbE in mega data centers. The success of 40GbE, which has been looked down on as an intermediate step from 10GbE to 100GbE, clearly illustrates the need for just such intermediate steps. History is likely to repeat itself with adoption of 400GbE, benefiting 200GbE optics, which many consider an unnecessary step along the way. LightCounting’s latest Ethernet forecast, released with the High-speed Datacenter Optical Interconnects report, increases our projections for 200GbE products in 2018-2021.

The updated report leverages extensive historical data on shipments of Ethernet and Fibre Channel interface modules combined with market analyst research to make projections for sales of these products in 2016-2021. The report offers a comprehensive forecast for more than 50 product categories, including 10GbE, 25GbE, 40GbE, 50GbE, 100GbE, 200GbE, and 400GbE transceivers, sorted by reach and form factors. It provides a summary of the technical challenges faced by 100GbE transceiver suppliers, including a review of the latest products and technologies introduced by leading suppliers. The report is based on confidential sales information and detailed analysis of publicly available data released by leading component and equipment manufacturers along with considerable input from industry experts, including many mega datacenter operators.